does maine tax retirement pensions

The 10000 must be. Maine does not tax active Military pensions - AT ALL.

Saving Outside Of Work Through An Individual Retirement Account Ira Individual Retirement Account Retirement Accounts How To Plan

Maine Public Employees Retirement.

. Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments or to change their withholding election. MA pensions qualify for a pension exemption. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax.

Deduct up to 10000 of pension and annuity income. Ad What Are Your Priorities. How Are Teacher Pensions Calculated in Maine.

Reduced by social security received. The figure below illustrates how a teacher pension is calculated in Maine. MaineSTART offers tax advantaged retirement savings plans.

In Montana only 4110 of income can be exempt and your adjusted federal gross income must be less than 34260 to even qualify. With Merrill Explore 7 Priorities That May Matter Most To You. Is my retirement income taxable to Maine.

With Merrill Explore 7 Priorities That May Matter Most To You. 454 for income above 150000 individuals or 300000 married filing jointly. To All MainePERS Retirees.

Benefit Payment and Tax Information. You will have to. Pension wealth is derived from a formula.

In addition for Louisiana individual income tax purposes retirement benefits paid under the provisions of Chapter 1 Title 11 of the Louisiana Revised Statutes including. However that deduction is reduced in an amount equal to your annual. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax.

Maine tax law allows for a pension income deduction to all its pensioners on Schedule 1. Ad What Are Your Priorities. Maine allows for a deduction of up to 10000 per year on pension income.

You also need to consider Maine retirement taxes as they apply to pensions and distributions when choosing a place to settle after working for so many years. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. Highest marginal tax rate.

MA pensions qualify for the pension exemption. Arizonas exemption is even lower 2500. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state.

These voluntary programs can help eligible public school teachers supplement their retirement. June 6 2019 239 AM. Military retirement pay is exempt beginning Jan.

In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who. For tax year 2004 the maximum exemption is 40200. 52 rows Maine.

Maine Retirement Tax Friendliness Smartasset

Salaries In Over Half Of The U S Won T Pay The Bills Being A Landlord Salary Cost Of Living

Social Security Is A Critical Source Of Retirement Income Yet By 2030 The Trust That Helps Fund Benefits Diy Woodworking Woodworking Plans Retirement Income

2020 S Best States To Retire Home Health Aide Retirement Smart Money

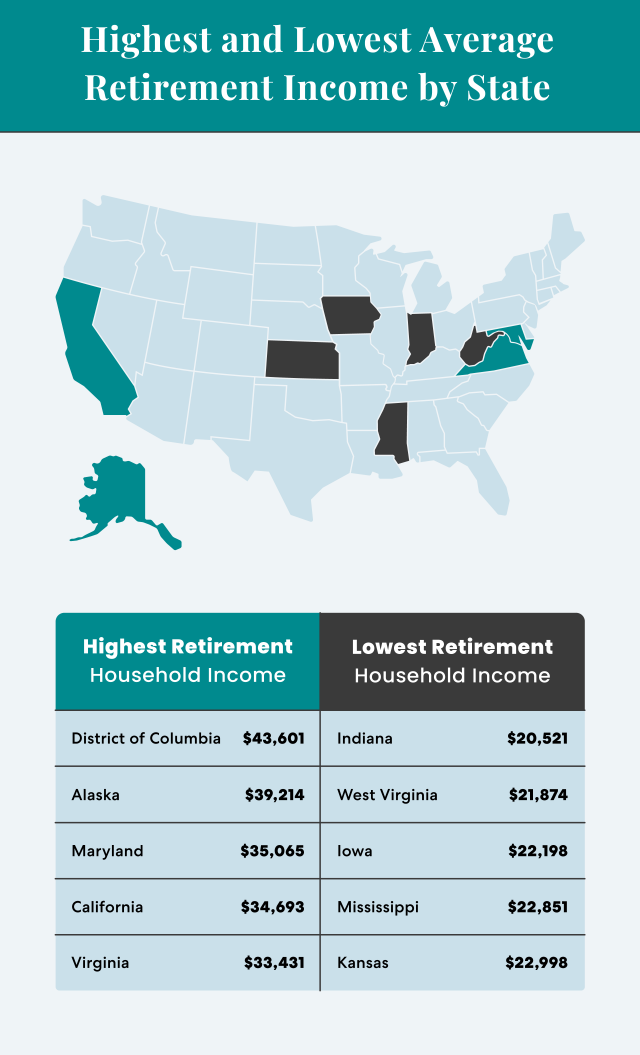

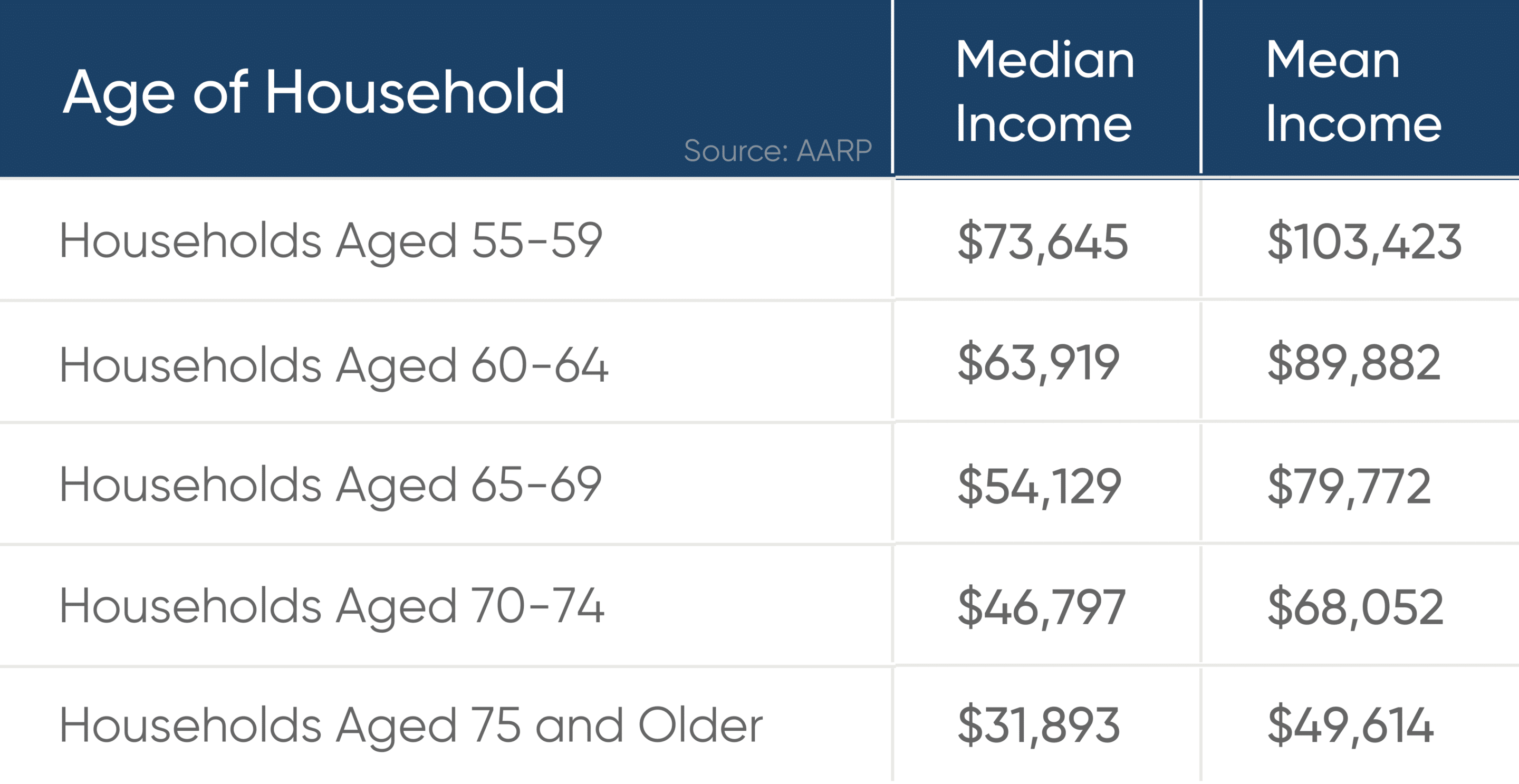

Average Retirement Income Where Do You Stand

Advisors Pivot To Cryptocurrencies As Clients Want In On The Action Retirement Advice Advisor Financial Advisors

Soap Note Example Download The Free Printable Basic Blank Medical Form Template Or Waiver In Word Excel Or Pdf To Be Us Soap Note Templates Speech Activities

Pros And Cons Of Retiring In Maine Cumberland Crossing

How To Become A Physical Therapy Assistant Pta Requirements Physical Therapy Assistant Physical Therapist Assistant Physical Therapy Education

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

States That Don T Tax Retirement Income Personal Capital

Maine Retirement Tax Friendliness Smartasset

Mercer Nz On Twitter Retirement Age Different Countries Country

Average Retirement Income For Seniors Goodlife Home Loans

Protect Yourself And Your Device Taxes Security In 2021 Tax Refund Saving For College Tax Debt

Best Worst Us States For Social Security Disability Approval Social Security Disability Social Security Social Security Disability Benefits